How to Get Money Back from Fraud Transaction As Per RBI Fraud Refund Policy (Full Refund): In this post we will discuss about ways to get money back after fraud transaction from your Credit Card and Debit Card, can we get money back after fraud transaction, can I get my money back from a bank transfer, and how to get money back after being scammed online. With new financial technologies and financial innovations more and more people are using online banking and online fund transactions for various reasons. Whether it is online shopping on e-commerce marketplaces or small transactions for a cup of coffee, we all love cashless digital transactions.

It is easy, exciting and extra fast. But these digital transactions have also put our funds at risk. Bad guys are finding new smart ways to fraud people and they are stealing money from credit cards, debit cards and bank accounts. In this article we will let you know that if ever such an incident happens with you then instead of panicking about how easily you can get your money back after a fraud transaction. Possibly full refund. In 2017 Reserve Bank Of India (RBI) provided a guideline to all the banks for unauthorized transactions which is a big comfort for bank account holders, credit and debit card users.

Main Actions In Event Of Unauthorized Transactions or Fraud Transaction To Get Money Back After Fraud Transaction From Your Credit Card And Debit Card is report immediately to your bank

How to Get Money Back from Fraud Transaction

As per the RBI guidelines, when you experience any unauthorized transaction or fraud transaction then you should immediately report this event to your bank, your credit card authoriser bank, and or debit card issuer bank. Call the bank customer support number and inform them with full details of how much money has been deducted from your account or card, when it has been deducted and where the transaction happened.

This is the basic thing you need to do after any fraud transaction. Bank or your credit or debit card issuer company will ask you some basic questions about the event and then will make sure the transaction has not been made intentionally by you. Or you have not provided your banking credentials or credit or debit card credentials either knowingly or unknowingly by mistake.

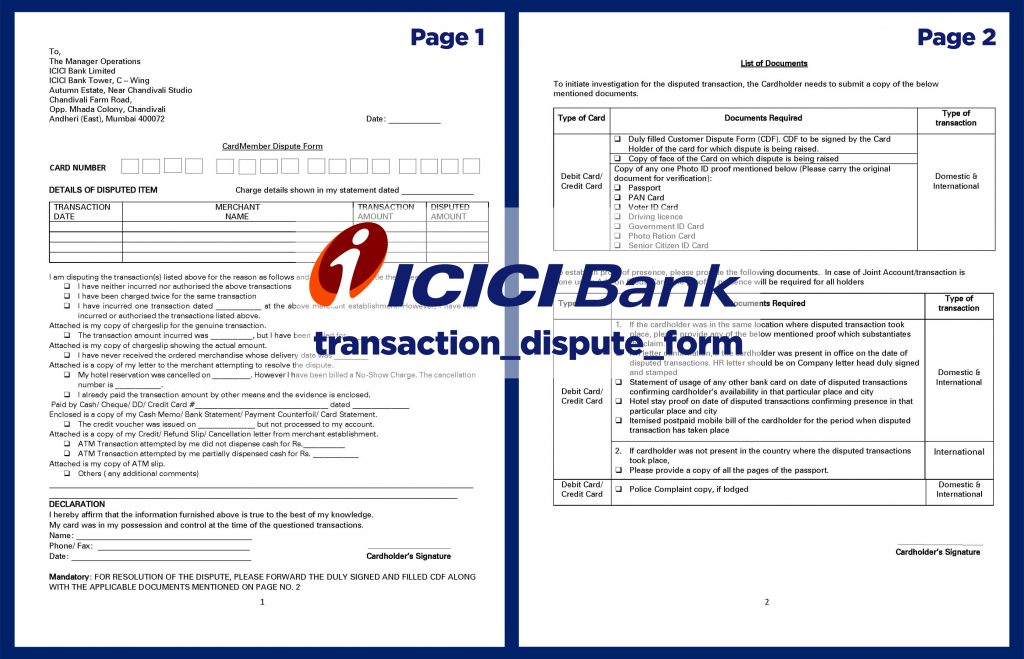

After collecting basic information regarding your fraud transactions or unauthorized transaction bank will ask you to fill up the transaction dispute form. In the transaction dispute form you need to fill in the correct information regarding the fraud transaction which has happened with you: where it has happened, when it has happened, what is the total transaction amount and how it has happened.

Then in that same transaction dispute form you need to fill up your complete banking details or your credit or debit card details. And you also need to provide your valid residential address and identity proof such as your aadhaar card, pan card, passport etc if you are from India and you hold your bank accounts or credit or debit cards in India.

Then after filling the form you need to sign it by accepting the terms and conditions then you need to send this transaction dispute form back to the bank or your card issuer company by their provided email address to get your money back after any fraud transactions.

Usually a bank or credit or debit card issuer company takes minimum 10 to 45 days to verify all the details and after successful verification they refund the full amount in your source account from which the fraud transaction happened. However in some cases banks or credit card companies may provide you only partial refund.

These days all top government and private bank or credit card companies send immediate notifications on your registered mobile number and email address and also they make automated phone calls too on your registered mobile number to make you aware of the transactions. And if you find that it is unauthorized transaction or fraud transaction then you should immediately report this activity to your bank or credit card company. The bank and credit card companies are doing their best to keep us safe and make our digital payments easy and trustworthy.

But as an account or card holder it is our responsibility too to practice safe and secure methods for any online transactions. If we will help our bank or credit card company to serve us better then they are always with us to make our lives safe and secure to assist us better and keep our funds safe.

Key Points And FAQs

Can We Get Money Back After Fraud Transaction?

Yes, if you practice safe and secure methods of online banking and any digital transactions provided by your bank or credit card company.

Can I Get My Money Back From A Bank Transfer?

Yes, you can get your money from a bank transfer if that bank transfer is an unauthorized transaction. And if you have reported the transaction event to the bank in a timely manner.

How To Get Money Back After Being Scammed online?

Report your bank or credit card issuer company regarding the fraud transaction within 3 days. Bank or your credit card company will ask you to fill a transaction dispute form.

Fill the form and provide your resident and identity proof along with a pan card photo copy and send it back to your bank or card issue company or visit the nearest branch to deposit the form in person.

What Is The Time Frame To Report Unauthorized Fraud Transaction?

As per the RBI guidelines you need to report the fraud transaction within 3 days.

What Is Unauthorized Transaction Or Fraud Transaction?

Any amount transferred from your bank account or credit or debit card against your will, without your knowledge and without your approval is called unauthorized transaction or fraud transaction.

What is the Transaction Dispute Form?

A transaction dispute form is a form provided by your bank or credit card company to provide information regarding fraud transactions along with your account information is called transaction dispute form.

What Is The Example Of Transaction Dispute Form?

Here in this image below we have provided ICICI Bank’s transaction dispute form as an example.

Where You Can Get Transaction Dispute Form?

You can download the transaction dispute form to report fraudulent transactions or fraud transactions from your bank’s official website or you can ask your bank or credit card company to send you a link to download the form or you can get it from any nearest branch of your bank or credit card company.

Conclusion

Although we all obey the guidelines provided by bank or credit card companies for online transactions or safe and secure uses of debit and credit cards. However an unforeseen situation may arrive and we do not have control over this and online scam or fraud transactions can happen with anyone. But whenever it happens, you should not panic and you should take immediate action. Report it immediately to your bank and credit card company.

Follow the instructions provided by them and chances are you will be safe and secure and you will be able to get your full money bank from any fraudulent or fraud transaction. Hope now you understand how to get money back from fraud transaction.

You May Also Like To Read: 11 Ways To Protect Bank Account From UPI Fraud

Loanvent Loanvent is a personal finance blog to stay updated with information on loans, credit cards, investments, digital finance, and how to make money online.

Loanvent Loanvent is a personal finance blog to stay updated with information on loans, credit cards, investments, digital finance, and how to make money online.